What does a high-quality carbon credit mean?

Do you want to buy carbon credits, but feel confused and uncertain about their quality? Many credit buyers feel the same way and struggle to navigate through various quality standards out there. As you may remember from our previous blog, carbon markets have tremendous potential to enhance the flow of financing to developing countries and accelerate climate mitigation action across the world. Apparently, in order to fill the gap in the financing necessary to stay on the pathway to limiting global warming to 1.5 °C, voluntary carbon markets need to grow by more than 15-fold by 2030 (Source: Final Report of TSVCM). Moreover, to drive the growth of carbon markets and to achieve their true potential, the quality of carbon credits has to be effectively ensured.

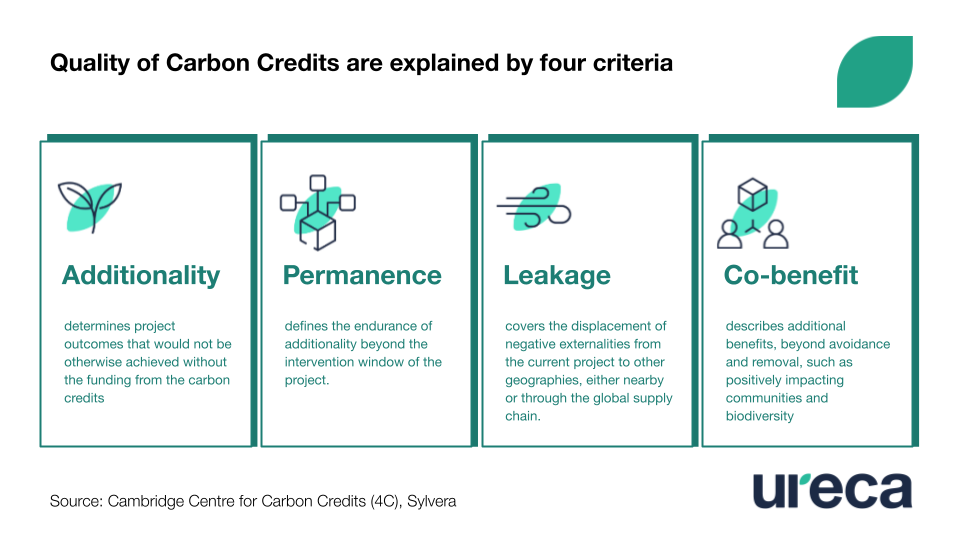

Various criteria come into play in determining the quality of credits, which vary depending on the carbon-crediting program. Generally speaking, the majority of carbon offset projects adhere to standards provided by Verra, Gold Standard, American Carbon Registry, and Climate Action Reserve. The most commonly reviewed quality attribute across these reputable carbon-crediting programs are additionality, permanence, leakage, and co-benefits. The quality of the carbon credit depends on the extent to which the offset activity fulfills these four criteria. Let’s dig deeper into each criterion.

Carbon-crediting program

A standard-setting program that registers mitigation activities and issues carbon credits

No 1. Additionality

Like two sides of the same coin, the quality of credits is inseparable from the concept of additionality. It is the most fundamental and quintessential quality criteria of all the respectable carbon-crediting programs such as Verra (Tool for Assessment of Additionality), Gold Standard (Principles & Requirements), American Carbon Registry (Standards & Methodologies), and Climate Action Reserve (Program Manuals and Policies). In short, emission reductions or sequestration from carbon offset projects are regarded as additional if the project wouldn’t have taken place in the absence of the added incentive and revenue generated by selling associated carbon credits (Source: WWF). The following non-exhaustive list shows the ways in which the additionality of an offset activity can be measured: financial viability and attractiveness, barriers to implementation, market penetration rates, and consideration of legal requirements.

(i) Financial viability and attractiveness

The emission reduction or removal is considered additional if revenues from carbon credits made the project financially viable and/or attractive. For instance, if a lower-income household is only able to afford a solar panel with the help of carbon financing, then the project satisfies the additionality requirement. The project developer can use data from existing projects or reach out to experts to assess a project’s financial viability and attractiveness.

It is worth noting that, renewable energy projects (i.e. wind and solar farms) are becoming more affordable with access to multiple financing options besides revenues generated from carbon credits. Therefore, to drive financing to projects that are not viable without incentives from carbon credits, Verra (VCS Standard) and Gold Standard (Renewable Energy Activity Requirement) stopped registering renewable energy projects, except for those in the least developed countries.

(ii) Barriers to implementation

In the case of financially viable carbon offset projects, they can potentially meet the ‘additionality’ criteria if the project is prevented by various implementation challenges such as limited access to technology, lack of infrastructure to utilize technologies, or lack of operational know-how. For example, the lack of trained personnel for research and development of carbon capture and storage technologies can be seen as a significant barrier to implementation. Thus, if carbon markets alleviate the identified barriers that prevent the project from occurring, then the project may qualify for the additionality requirement.

(iii) Market penetration rates

In the absence of carbon markets, especially in developing countries, many new technologies never get the chance to be deployed. Hence, projects that are among the first of their kind in terms of technology are considered ‘additional’. To show that the technology has a low market share, the project developer uses market penetration rates as evidence. For instance, in the case of a solar farm, a project developer demonstrates penetration rate using the market share of solar farms in relation to all types of power plants in the market.

(iv) Consideration of legal requirements

A legal requirement test ensures that a said project is not being implemented for the sake of compliance with local, national or international regulations. For example, an avoided deforestation project might be carried out because a local Environment Act prohibits tree felling. This is an important requirement since it eliminates compliance-based projects that would have occurred regardless of their carbon credit potential. However, if legislation has not been enforced yet, a project can meet the ‘additionality’ component until enforcement takes place. Depending on the carbon-crediting program, such projects may be required to demonstrate that the law is still not in force during each verification period.

No 2. Permanence

Another important benchmark to demonstrate quality is ‘permanence’, which refers to the permanence of the emission reduction or removal. This means that the impact of these projects is not reversed for a long period of time. Most commonly, nature-based solutions such as Agriculture, Forestry, and Other Land Use (AFOLU) projects face higher levels of reversal risks because of their vulnerability to extreme weather events such as floods, fires, droughts, hurricanes, volcanoes, earthquakes, and landslides. For instance, a wildfire may re-emit some or all of the carbon that was removed from the atmosphere, leading to a reversal of the impact. It must be noted that some projects such as tech-based solutions are not subject to non-permanence risk as they cannot be released back into the atmosphere.

All projects, especially AFOLU projects, must submit a non-permanence risk report to their respective carbon-crediting programs (see the VCS Program document AFOLU Non-Permanence Risk Tool or American Carbon Registry’s ACR Tool for Risk Analysis and Buffer Determination). The ‘risk assessment report’ can help projects manage reversal risks through mitigation measures. To illustrate, a project developer can assess the local fire history, determine the fire risk and its sources and then establish the most appropriate fire protection measures.

On top of that, carbon-crediting programs tend to have “buffer reserves” or pools of carbon credits to mitigate the reversal of emission reductions or removals (see Gold Standard’s GHG emissions reduction & sequestration product requirements or Climate Action Reserve’s Offset Program Manual). When the reversal occurs, the credits are retired from buffer reserves to compensate for reversals. This pool of credits functions as an insurance mechanism. If projects have mitigation measures, they can have a lower level of credit to buffer reserves.

In the near future, we might be able to exploit the use of satellite data, AI, and Blockchain to measure the permanence and potential leakage of nature-based solutions. In fact, to address the inherent permanence risks of nature-based solutions, Verra is proposing a Long-term Reversal Monitoring System which will use remote sensing and cutting-edge technologies to detect and quantify reversals.

No 3. Leakage

Leakage refers to an increase in GHG emissions outside project boundaries caused by project implementation. The potential risks of leakage must be identified for AFOLU projects and considered in the calculation of emission reductions. However, leakage beyond national boundaries does not need to be considered in the assessment (see Verra’s Estimation of Emissions from Market Leakage and the Gold Standard’s Leakage Template). There are mainly two types of leakage: activity shifting leakage and market leakage.

(i) Activity shifting

The existing activities can shift emissions to another location that is not monitored under the project. For example, an avoided deforestation project could cause a landowner to shift his/her commercial fuelwood harvesting activity to other locations outside the project boundary. This would effectively annul some or all of the emission reductions achieved by the project.

(ii) Market leakage

Market leakage occurs when a project reduces the production of a commodity, resulting in a shift of production elsewhere to make up for the lost supply. The risk for leakage becomes higher as commodity prices rise. At the project's scale, certain leakages can be prevented through extended monitoring systems that will allow them to detect emissions outside their project boundaries. Furthermore, leakages can be mitigated through careful selection of project sites, hiring guards, teaching local communities about sustainable forestry, and helping them in their transition to producing sustainable forest products. It is common for carbon-crediting programs to deduct potential leakage estimates from the total forecasted GHG emission reduction or removal of projects.

No 4. Co-benefits

The carbon-crediting programs require that all projects consider related environmental and socio-economic impacts including impacts on sustainable development goals ("SDGs"), as well as risks posed on local stakeholders during the implementation. If there is a positive SDG impact, the carbon-crediting program can assess and require validation by third-party auditors.

Third-party auditor

An independent validation and verification body that meets the competency requirements laid out in ISO 14065 and ISO14066 and is accredited by the International Accreditation Forum (IAF)

That means carbon credits can be labeled with additional certifications (see Gold Standard’s Claim Guidelines and Verra’s Labels Verra). For example, the Gold Standard certified project Solar Cooking for Refugee Families in Chad, eliminates health issues caused by smoke and fire outbreaks (SDG Goal 3. Good Health and Well-being), empowers women through employment (SDG Goal 5. Gender Equality), avoids 20,000 tonnes of CO2 eq. annually (SDG Goal 13. Climate Action) and helps to avoid conflict between refugees and locals over scarce resources (SDG Goal 16. Peace, Justice, and Strong Institutions). Typically, nature-based solutions provide a wide range of additional benefits such as enhancing biodiversity, water quality, soil quality, and livelihoods.

Environmental and social impacts, including SDGs, facilitate the liquidity of carbon credits and is important to credit buyers. For this reason, carbon-crediting programs have additional certifications to give assurance that a project has a net positive impact on the environment and society.

Final Remarks

In this blog, we attempted to clarify the most common quality criteria across reputable carbon-crediting programs in order to give you a grasp of how to assess the quality of carbon credits. If you still feel overwhelmed about the quality of credits, you can reach out to carbon rating agencies such as Sylvera, BeZero Carbon, and Calyx Global, which provide independent and unbiased ratings and allows you to compare the quality of credits. In addition, to establish a consistent benchmark for high-integrity carbon credits, the Integrity Council for the Voluntary Carbon Market released the draft of Core Carbon Principles (“CCPs”). The CCPs are expected to facilitate the development of the voluntary carbon market and the achievement of robust emission reductions in line with the 1.5 °C pathway. Next week, we will discuss future trends in carbon projects to help you to choose the right project.

Comments ()