Let’s demystify the generation of carbon credits

Do you feel completely mystified when international organizations like the UN or corporations like Alphabet bring up the use of carbon offsets in achieving their net-zero targets? Then, you’re not alone. To begin with, according to the Emissions Gap Report 2021, country commitments to reduce global emissions by 2030 adds up to 7.5% below the emission rate of 1990, but 45% is necessary for limiting global warming to 1.5°C. If we stay on the current emissions trajectory, it would result in a warming of 2.7°C, which will very likely lead to irreversible and catastrophic impacts. We simply cannot rely solely on governments to achieve such a degree of cuts in emissions, thus an active participation of companies and communities are vital. To do so, science-based targets ("SBT"), which was explained in our previous blog, need to be employed urgently.

Carbon credit

Carbon credit corresponds to one metric ton of reduced or removed CO2 or equivalent greenhouse gases

Voluntary carbon market

Voluntary carbon markets refer to the issuance, buying and selling of carbon credits on a voluntary basis

We can potentially decarbonize our operations by 90 percent through the SBTs, which means that inevitably, there will be some residual emissions that cannot be reduced, but can be addressed through carbon offsets. Carbon offsets not only serve to address emissions that are absolutely unavoidable but also fill the gap in the flow of climate finance to developing economies and accelerate the development of innovative mitigation technologies. In this blog, we will focus on the generation of carbon credits in the existing voluntary carbon markets to help you understand how it works. Now, let’s dig down into how carbon credits are created.

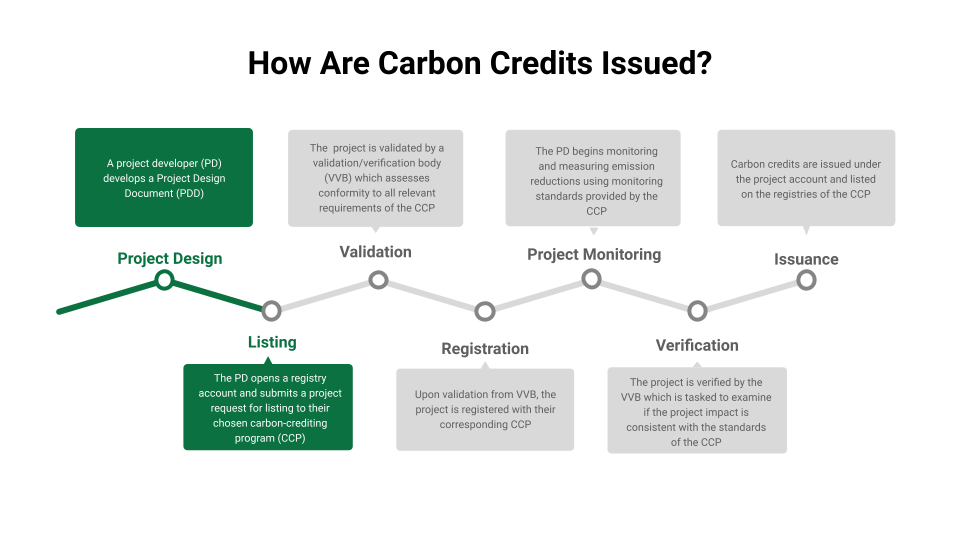

Lifecycle of carbon credits

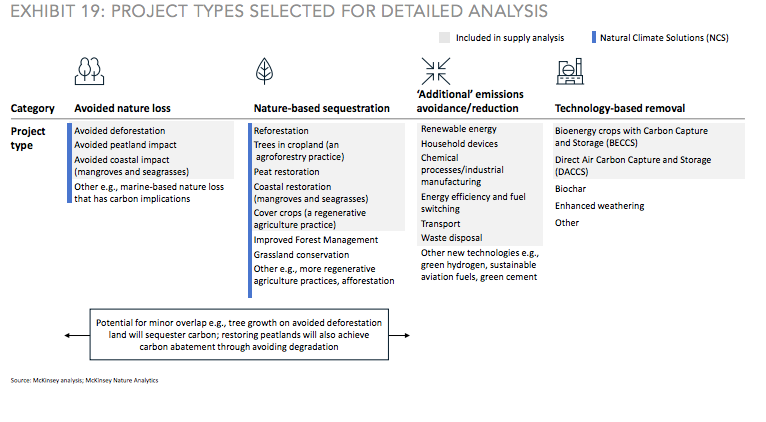

To put it briefly, projects that remove or reduce greenhouse gases ("GHGs") from the atmosphere to counteract emissions elsewhere are called carbon offset projects. It can range from micro-scale activities such as an installation of clean cookstoves or large-scale projects like solar farms. Generally, there are four types of carbon offset projects (see below excerpt from the report by TSVCM).

(1) Project design

A project developer selects a methodology applicable to their proposed project type and develops a Project Design Document ("PDD") which mainly contains a project description, baseline determination, additionality assessment, identification of mitigation activity proponents and other requirements. It is common for project developers to choose methodologies and standards approved by carbon-crediting programs ("CCPs") such as the Gold Standard, American Carbon Registry and Verra’s VCS Program.

Additionality

Greenhouse gas emission reductions or removals from carbon offset projects would not have occurred in the absence of the incentive created by carbon credit revenues

Carbon-crediting program

A standard setting program that registers mitigation activities and issues carbon credits

(2) Open registry account for listing

After the design stage, a project developer needs to open a registry account and submit a project request for listing at their chosen CCP who will review submitted documents including the PDD and may request clarification if needed. It is important to point out that most projects are directly approved by validation and verification bodies (“VVBs”), meaning projects don’t require preliminary design approval from their chosen CCPs to undergo a validation process. However, certain CCPs such as the Gold Standard require preliminary design approval before validation takes place.

Validation and Verification Body

A third-party auditor that meets the competency requirements laid out in ISO 14065 and ISO14066 and is accredited by the International Accreditation Forum (IAF)

(3) Validation

Following the listing process, the project must be validated by a VVB, or so-called third-party auditors, who are responsible for assessing conformity to all relevant requirements of that particular CCP. To do so, VVB reviews a PDD and makes a field visit which can be quite a costly endeavor for projects, especially for small ones. Each CCP tends to have a list of accredited VVBs, such as the following: Gold Standard Validation and Verification Bodies, American Carbon Registry’s Accredited Verification Bodies and Verra’s Validation/Verification Bodies.

(4) Registration

Upon validation from a VVB, projects are registered with their corresponding CCPs. In certain cases, despite being validated by VVBs, a few CCPs conduct an additional review of a PDD, and if approved, the carbon offset programs get registered. For instance, the Gold Standard requires additional approval by a carbon impact verification organization called SustainCERT before registering carbon offset projects. An official project registration means that it has been approved by their CCP and is eligible to start generating carbon credits.

(5) Project Monitoring

When the registered carbon offset project commences, then a project developer can begin monitoring and measuring emissions reductions using monitoring standards provided by their chosen CCPs such as the Gold Standard's Monitoring Report, American Carbon Registry Monitoring Report and Verra’s Monitoring Report Template. The monitoring report is designed for the purpose of verification, which will result in the issuance of carbon credits.

(6) Verification

The project has to be verified by an accredited VVB, which is tasked to examine if the project impact is consistent with the standards of that particular CCP. To conduct verification, the VVB reviews monitoring reports and makes another field visit. In the voluntary market, verification is usually the last step before the issuance of carbon credits. However, projects that are registered with the Gold Standard and Verra's VCS Program will need to acquire project verification approval from their respective CCPs.

(7) Issuance of carbon credits

Based on verification reports concluded by a VVB, a project is issued a carbon credit such as a Gold Standard’s Verified Emission Reduction (GS-VER), American Carbon Registry’s Verified Emissions Reductions (VERs), or Verra’s Verified Carbon Units (VCU). A carbon credit represents one metric ton of removed or reduced GHG from the atmosphere. The credits are issued under the project account and listed on the registries of that particular CCP. These credits can be traded until end-buyers decide to retire them in order to claim their associated GHG reductions towards their goals.

Final Remarks

The above illustrates how carbon credits are issued by carbon-crediting programs (CCPs) with the facilitation of validation and verification bodies (VVBs). For small-scale project developers, starting a carbon offset project might seem like an overly lengthy, complicated and costly process. In order to scale the voluntary carbon markets and accelerate mitigation actions among vulnerable communities, we have to mobilize small and micro-scale projects in developing nations.

Thus, URECA is working to ensure universal access to the voluntary carbon market by replacing the existing monitoring and verification process with a digital MRV (Monitoring, Reporting and Verification) process that can cut costs and time substantially. We firmly believe that universal access to the voluntary carbon markets can contribute in driving the flow of financing to small and micro projects in developing countries.

Comments ()