The Core Carbon Principles: Leading the Way for a Sustainable Future?

What are the Core Carbon Principles and should we care about them?

If you follow the voluntary carbon market, you may have noticed that the Core Carbon Principles (CCPs), introduced by The Integrity Council for the Voluntary Carbon Market (ICVCM), is an initiative to offer the go-to standard document for all carbon credits that are created through offset projects. Their intent is to improve the quality of carbon credits by reducing the noise created by various different standards, which make it difficult to compare projects directly. With one governing standard for all, all projects are judged and assessed by the same metrics. If the ICVM can truly pull this off, they may provide a massive improvement to the current system by helping to expand the consumer base who are more inclined to trust the market. In this blog, we’ll unpack the CCP-s and allow you the opportunity to make your own educated judgment regarding its merit.

Who?

- The ICVCM is a group of progressive investment businesses, asset managers, and financial professionals, that have recognized that intensifying the voluntary carbon market is critical in anchoring private investments to fight climate change.

What?

- Diverse experts work to create and continuously strengthen an ecosystem that facilitates the Voluntary Carbon Market (VCM) to identify carbon credits that are of high quality.

- They endeavor to increase the volume of private investment channeled particularly to offset projects involving local and indigenous communities. The VCM is currently valued at around $2 billion, quadrupling in the market value from 2020 (ICVCM, 2022).

How?

- They aim to reach their goal by creating, hosting, and upholding a set of Core Carbon Principles (CCPs) that offers new requirements for high-quality carbon credits and specifies which carbon-crediting schemes are CCP-eligible.

- They aim to supervise and guide organizations that develop CCP compliance requirements, market infrastructure, and participant eligibility.

- They aim to expand the VCM by fostering collaboration between various organizations through their rigorous outreach activities.

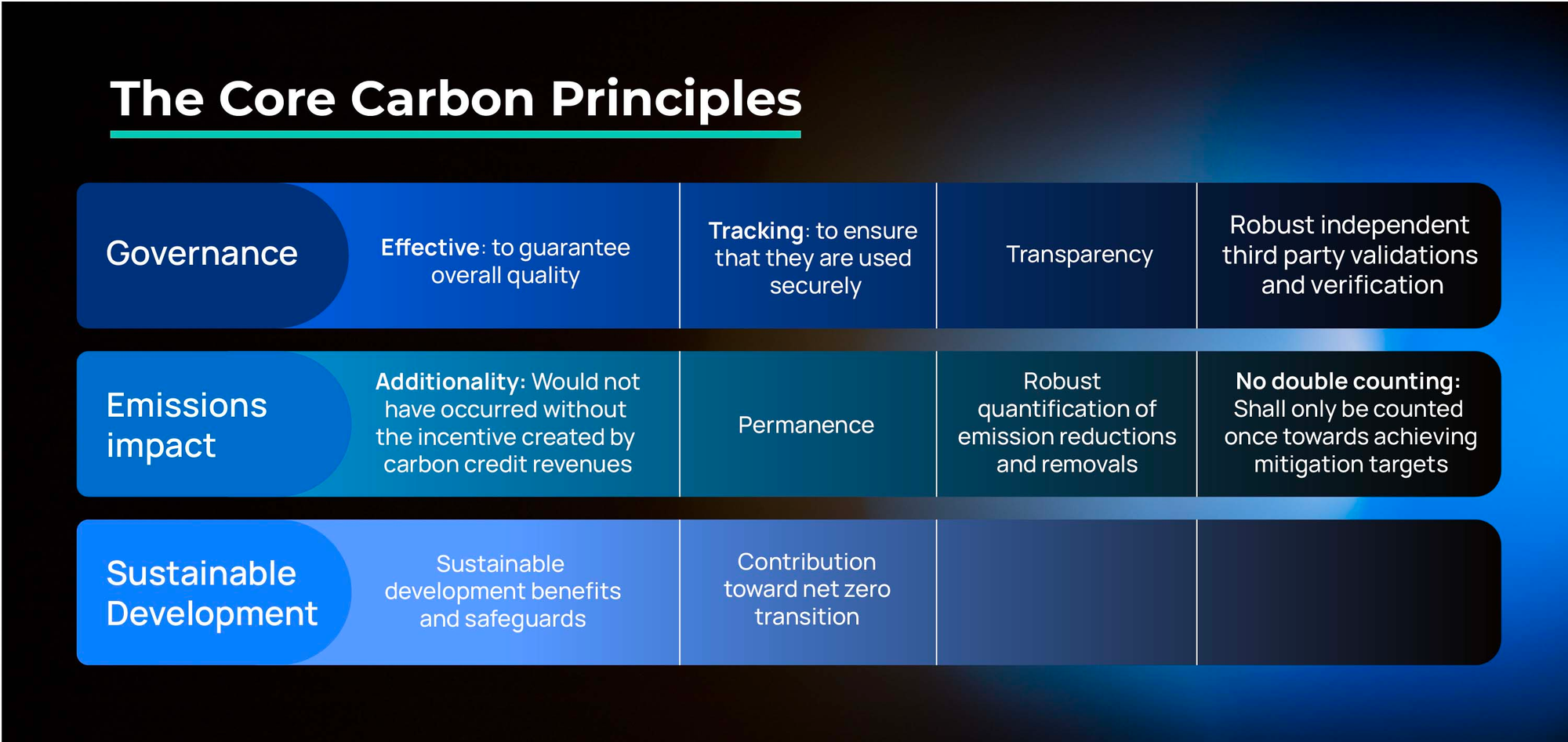

In a nutshell, the CCPs strive to become the global standard for high-integrity carbon credits. The VCM has the power to unlock urgently needed finance to reduce and remove billions of tons of emissions that can enable the transition to a 1.5°C trajectory by 2030. The CCPs have stringent transparency and sustainable development requirements that provide a credible and rigorous method of identifying high-integrity carbon credits with genuine, verifiable impact that is based on the most recent science and best practices to build trust in the voluntary carbon market.

In order to become CCP labeled, you have to go through the Assessment Framework, which provides criteria and tools for each of the principles. First, the credits should fund projects to reduce emissions compatible with a transition to net zero, achieving a balance between the carbon emitted and extracted from the atmosphere by 2050 (Energy Saving Trust, 2021). Secondly, the project has to be permanent, (compensating for any reversals within 40 years) and additional (truly dependent on revenues from the carbon market to be implemented). Finally, the projects must be robustly quantified and measured conservatively to minimize the risk of overestimation.

But wait, after all that, there is more! The project then goes through examination by three different working groups, with one being the ICVCM Board itself. If you’re successful, you can officially be a CCP-labelled project.

Here are the 10 Core Carbon Principles that were established to ensure integrity:

Since the CCPs are newly established, it calls for several opportunities. Buyers will have more faith in the ability to identify and value high-integrity carbon credits knowing that the projects were rigorously inspected and examined before being CCP labeled. As a result, there will be less ambiguity and less market fragmentation, and buyers will feel more secure knowing that they are supporting programs that decrease emissions and involve local and indigenous communities (holding three seats out of 22 in the ICVCM board).

Additionally, due to its eco-friendly classification, investments can become worthwhile initiatives like conserving biodiversity and supporting native lands with weak carbon sinks among others. As a result, CCPs have several advantages that are in line with environmental goals. They draw investors who care about the environment and encourages ethical investing.

However, it can be challenging for businesses to determine whether they are actually decreasing their emissions without accurate carbon measurement. The lack of data, particularly in developing countries can make it impossible to assign ratings to carbon credits.

Now that the CCPs have launched, several organizations and companies have stated their stance. The Head of Climate Mitigation at the UNEP, Gabriel Labbate, stated that the CCPs were established to ensure integrity, and they play a chief role in supplying money for the preservation and recovery of our forests and other ecosystems. ClimateTrade concurred and asserted that by adhering to the CCPs, the bar for climate action will be lifted. On the contrary, Verra and Gold Standard, the standards for certifying carbon emissions reductions (big giants of carbon standards), criticized ICVCM as being overly prescriptive and possibly setting lower standards for to uphold. Although they appreciate the careful examination of the projects, the approach and requirements seem too “one-size-fits-all”.

There was a recent Guardian article that created a controversy regarding Verra registered projects showing that a majority of rainforest carbon offsets were actually not quite as they were reported to be in terms of project impact (Greenfield, 2023). The controversy showed how challenging accurate carbon measurement can be, and the importance of transparency and tracking, one thing that the CCPs hope to address. Many existing standards face issues with the amount of time they take to verify projects. Although the ICVCM does not give any promise on duration of the assessment, its Category working group will categorize the projects in one of following groups: fast track consideration, deeper assessment and very unlikely to meet the requirements. This step is expected to reduce the time needed for the assessment. Many existing standards face issues with the amount of time they take to verify projects.

In the case of URECA’s marketplace, many of our listed projects are from the Gold Standard, and the Verra registries, where you can invest in carbon credits, offset your own carbon emissions, and earn rewards and incentives to mitigate climate change. URECA believes that although there are definite advantages to the CCPs like its up-to-date principles, Gold and Verra have spent years honing their methodologies regarding, for example, renewable projects and nature-based solutions. Although there are no CCP-labeled projects as of today, they will start being released in Q3 of 2023, and the first revision process will be launched in 2025. The CCPs can encourage greater investment for effective climate action within national registries as well, and with the ICVCM’s operations of constant improvements in the principles and frameworks, it has the potential to ensure integrity and become a driver to reach the goal of 1.5°C. However, will it actually call for positive change in the carbon market? Or will it make it an even slower progression towards net zero? Guess we will have to wait and see.

Arocha, S. (2023, July 28). Introducing the High-Integrity CCP Label for Game-Changing Carbon Credits. UN-REDD. Retrieved from https://www.un-redd.org/post/introducing-high-integrity-ccp-label-game-changing-carbon-credits

ClimateTrade. (2023. August 2). The Voluntary Carbon Market is Changing. Here’s All You Need to Know About New High-Integrity Labels for Carbon Credits. Retrieved from https://climatetrade.com/the-voluntary-carbon-market-is-changing-heres-all-you-need-to-know-about-new-high-integrity-labels-for-carbon-credits/

Energy Saving Trust. (2021, October 25). What is Net Zero and How Can We Get There? Retrieved from https://energysavingtrust.org.uk/what-is-net-zero-and-how-can-we-get-there/#:~:text=The term net zero means,more than the amount removed.

Greenfield, P. (2023, January 18). Revealed: More Than 90% of Rainforest Carbon Offsets by Biggest Certifier are Worthless, Analysis Shows. The Guardian. Retrieved from https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe

Lanthorn, Kylie R. (2013). It's all About the Green: the Economically Driven Greenwashing Practices of Coca-Cola. Augsburg Honors Review. Vol. 6, Article 13.Retrieved from https://idun.augsburg.edu/honors_review/vol6/iss1/13/

The Integrity Council for the Voluntary Carbon Market. (2022). The Core Carbon Principles. Retrieved from https://icvcm.org/the-core-carbon-principles/#:~:text=The%20Core%20Carbon%20Principles%20(CCPs,on%20disclosure%20and%20sustainable%20development.

UN. (2023). Sustainable Development Goals. Retrieved from https://www.un.org/sustainabledevelopment/climate-change/#:~:text=To%20limit%20global%20warming%20to,2030%2C%20just%20seven%20years%20away.

Wright, J. (2023, April 24). ICVCM Launches Core Carbon Principles for Voluntary Carbon Market. Covington. Retrieved from https://www.insideenergyandenvironment.com/2023/04/icvcm-launches-core-carbon

Comments ()